The World of EZchargeback

An online fraud expert can guide you in the world of EZchargeback. The online scam has been prevalent in the recent past, with over 47% of the population having been the victim of some kind of financial fraud. Whether it’s investment scams or binary frauds, these experts can help you protect yourself and your money. There are over 100 pieces of informational literature on this site, including case studies and blacklisted companies. The site also includes literature on current scams that you may encounter online.

EZchargeback Process of Dispute Varies

The process of dispute varies from card issuer to card issuer. You can choose to dispute the charge by phone, email, or online. It’s important to note that this process is unethical, as it could lead to the loss of credit. Therefore, if you’re a victim of a EZchargeback, you should do so only when you’re certain that you should be getting a refund. The process can vary depending on the card issuer, but most allow you to dispute the charge online or via email.

EZchargeback can initiated by the customer or by the bank. When a customer initiates a chargeback, they typically contact the bank that issued their credit card. In most cases, a chargeback will be initiated because the bank detected an error, and is intended as a preventative measure. The reasons for chargebacks are diverse, from credit card fraud to the failure to receive a product. Chargebacks are designed to protect consumers, but the fees associated with these actions are expensive for both the merchant and the customer.

Online Transactions

In the world of ECommerce, claiming a EZchargeback has never been easier. Online transactions have become increasingly anonymous, making it difficult to verify buyer claims. Merchants are now more vulnerable to chargeback fraud, also called friendly fraud. This type of fraud is a type of friendly fraud that can occur both innocently and maliciously. A misunderstood delivery date may result in chargeback fraud. In this case, the consumer will dispute the chargeback claiming that it was fraudulent.

Once a EZchargeback has been filed, the issuing bank contacts the merchant bank to determine if the transaction was legitimate. During this time, the merchant has a limited window to contest the claim and get funds back. During this time, the bank must evaluate the evidence provided and make a decision on whether or not the chargeback is valid. The bank may also impose a fee on the merchant. You can avoid the hassles of a chargeback by using EZchargeback.

How EZChargeBack Works ?

Internet fraud has become a common problem for consumers today. In fact, it is estimated that 47% of the population has fallen victim to this type of scam. In order to help decrease this rate, you need to know more about online scams. To do this, you should become educated on a wide range of financial scams. Luckily, EZChargeBack has authentic information on investment scams and binary frauds. This site also has more than 100 informational materials, including case studies, blacklisted companies, literature about current scams, and more.

EZchargeback are an inevitable part of doing business, but if you’ve never had to deal with them before, you’re missing out! You’ll have to deal with them if you want to succeed in this competitive field. EzChargeback makes the process easier and more convenient for consumers. Using the service will save you time and energy, and you’ll be glad you did. Here’s how it works.

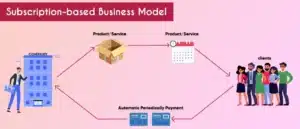

Common in Subscription-Based Businesses

First, EZchargeback are common in subscription-based businesses. Customers may not recognize a particular charge and file a chargeback in order to dispute it. In addition to this, chargebacks can initiated because of clerical errors. For example, a customer may forget to cancel their subscription and end up paying for it twice. Likewise, a faulty product may be delivered or a customer did not receive it within the stated time period. Either way, EZchargeback can be a nuisance for businesses, and you should take all possible measures to avoid them.

If you are a victim of fraud, you may be able to file a EZchargeback against a fraudulent company or a fraudulent online payment transfer. You should also report the scam to the company’s fraud department. Once you’ve received a rejection, you can dispute the chargeback with the issuing bank. The money will be deducted from your account and credited to the buyer’s. If your chargeback is accepted, you can recover your money and eliminate the fraudulent charges.

Management Solution is Essential

Using a chargeback management solution is essential for merchants to avoid these pitfalls. For example, EZchargeback can take six weeks to process, so you should be notified the minute the customer files a dispute. Using an EZchargeback management solution, such as Verifi’s Cardholder Dispute Resolution Network, you can receive instant notification if a dispute arises. By monitoring your charges, you can better protect your business and avoid chargebacks altogether.

The process of a EZchargeback differs from bank to bank, but in general, the process involves a customer requesting a chargeback. This bank then contacts the merchant and sends the funds to the customer. Depending on the payment provider, the bank can send the chargeback to its collection department. Then, the merchant can choose to dispute the chargeback, or opt for an alternative method. There are numerous ways to dispute a chargeback.